Legitimate title loan companies in San Antonio offer competitive rates, clear terms, and various options like Debt Consolidation and Truck Title Loans. They prioritize customer satisfaction, use digital technologies for swift approvals, and avoid predatory practices, ensuring peace of mind and minimal hassle when accessing emergency funds. These firms adhere to legal standards, providing transparent terms, efficient online applications, and fast turnaround times (sometimes within a day).

In today’s fast-paced world, unexpected financial needs can arise at any moment. Legitimate title loan companies offer a streamlined solution with their efficient approval processes. This article delves into the world of these reputable lenders, highlighting the key factors that contribute to their swift approvals. We’ll explore the benefits of choosing legitimate title loan providers and how they can be a game-changer in times of financial urgency, ensuring you access the funds you need without unnecessary delays.

- Understanding Legitimate Title Loan Companies

- Efficient Approval Processes: Key Factors

- Benefits of Choosing Reputable Lenders

Understanding Legitimate Title Loan Companies

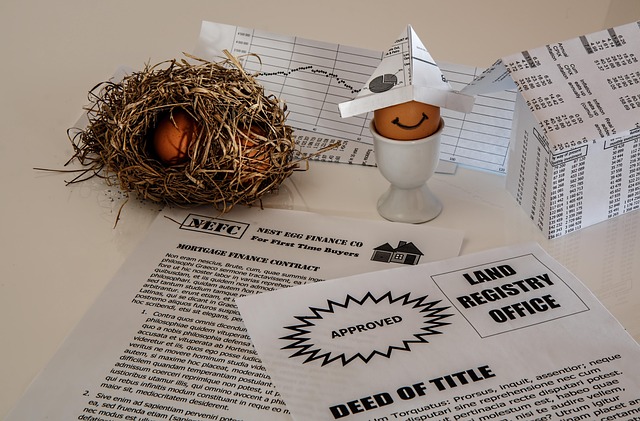

When considering a title loan, it’s paramount to differentiate between legitimate and illegitimate providers. Legitimate title loan companies adhere to state laws and regulations, ensuring a transparent and secure borrowing process. These businesses prioritize customer satisfaction and offer competitive interest rates, clear terms, and conditions that are easy to understand. They also provide various loan options like San Antonio Loans, Debt Consolidation, and Truck Title Loans to cater to different needs.

By choosing a reputable company, borrowers can avoid predatory lending practices and high-pressure sales tactics. Legitimate lenders foster an environment of trust and fairness, allowing individuals to access emergency funds quickly without compromising their assets or falling into debt traps. Such companies often have straightforward application processes and efficient approval times, making them a reliable solution for short-term financial needs.

Efficient Approval Processes: Key Factors

The approval process for loans from legitimate title loan companies is designed to be efficient and straightforward, catering to those in need of emergency funding quickly. Key factors that contribute to this speed include streamlined application procedures, advanced digital technologies, and a thorough yet rapid evaluation of borrowers’ collateral. These companies understand the urgency behind San Antonio Loans and have structured their systems to provide quick loan extensions when possible.

By prioritizing customer convenience and timely access to funds, legitimate title loan providers ensure that borrowers can receive emergency funding with minimal hassle. This efficiency is not just about processing speeds but also about clear communication and transparency throughout the entire lending experience.

Benefits of Choosing Reputable Lenders

When considering a title loan, one of the most crucial decisions is choosing a reputable lender. Opting for legitimate title loan companies offers numerous advantages, ensuring a safer and more favorable borrowing experience. These lenders adhere to legal and ethical standards, providing transparency in their terms and conditions. This means borrowers can understand exactly what they’re agreeing to without hidden fees or deceptive practices.

Moreover, dealing with reputed lenders streamlines the approval process. They often offer fast turnaround times, sometimes even within a day, thanks to efficient online applications and direct deposit options. Additionally, legitimate title loan companies may provide flexible payment plans tailored to individual needs, making it easier to manage repayments. This level of professionalism and adaptability is vital when navigating financial challenges, ensuring borrowers can access much-needed funds with peace of mind.

When seeking fast approval for a title loan, it’s crucial to partner with legitimate title loan companies. By understanding these providers and their efficient approval processes, borrowers can access needed funds quickly while enjoying the benefits of reputable lenders. Opting for legitimate title loan companies ensures a transparent, secure, and beneficial borrowing experience.