Item, Structure at a level in the ways /

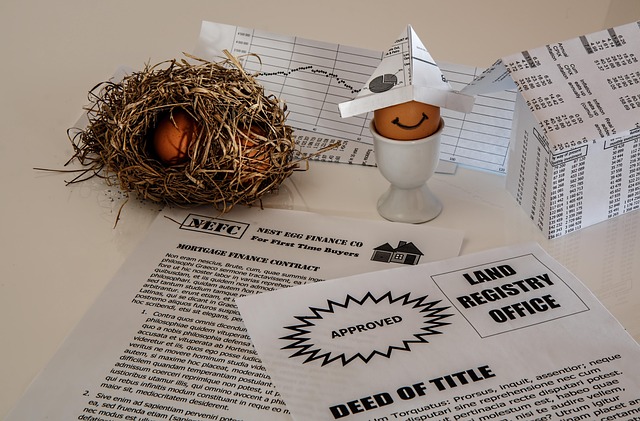

In the fast-paced world of short-term lending, understanding the regulation of legitimate title loan companies is crucial. Each state in the US has its own set of rules governing these loans, ensuring consumer protection and fair practices. This article explores the intricate web of state regulations, focusing on how they safeguard borrowers and differentiate legitimate operators from predatory lenders. By delving into consumer protection laws and providing practical tips for identification, we empower individuals to make informed decisions when considering a title loan.

- Understanding State Regulation of Title Loans

- The Role of Consumer Protection Laws

- How to Identify Legitimate Title Loan Companies

Understanding State Regulation of Title Loans

(Structure Highood / Focusing Item, Structure Method / Structure Bedove Rest Source Project

The Role of Consumer Protection Laws

In many states across the US, legitimate title loan companies are subject to stringent consumer protection laws designed to safeguard borrowers from predatory lending practices. These regulations play a pivotal role in ensuring fair and transparent interactions between lenders and individuals seeking fast cash solutions, such as loan extensions or debt consolidation options. By mandating clear terms, interest rate caps, and borrower education, these laws foster a more secure environment for those turning to title loans as a financial safety net.

State-level oversight is crucial in mitigating the risks associated with short-term lending. It encourages legitimate operations by weeding out fraudulent or unscrupulous companies that often prey on desperate borrowers. Through this regulation, consumers can rest assured that their transactions are legally protected, promoting trust and peace of mind when exploring options like title loans for immediate financial needs, whether it’s for unexpected expenses or consolidating debt.

How to Identify Legitimate Title Loan Companies

When considering a title loan, it’s paramount to identify legitimate companies to protect yourself from predatory practices. Legitimate title loan companies are typically regulated by state authorities and adhere to strict guidelines on interest rates, fees, and repayment terms. Check for certifications and licenses displayed prominently on their websites or physical locations. Reputable firms will be transparent about their policies, including upfront costs, annual percentage rates (APRs), and possible penalties for early repayment.

In the case of Houston Title Loans, for instance, companies that offer same-day funding should provide clear information on their loan terms and payment plans. Look for reviews from previous customers to gauge their experience and reliability. Legitimate operators will encourage open communication, ensuring you understand the entire process, from application to repayment, without hidden surprises. Always remember, a trustworthy title loan company prioritizes your financial well-being and offers flexible options tailored to your needs.

When seeking a legitimate title loan company, understanding state regulation is paramount. Each state has its own consumer protection laws that govern these loans, ensuring fair practices and safeguarding borrowers from predatory lending. By identifying regulated companies and adhering to best practices, individuals can access needed funds securely. Always verify the legitimacy of any title loan offer to avoid financial pitfalls.