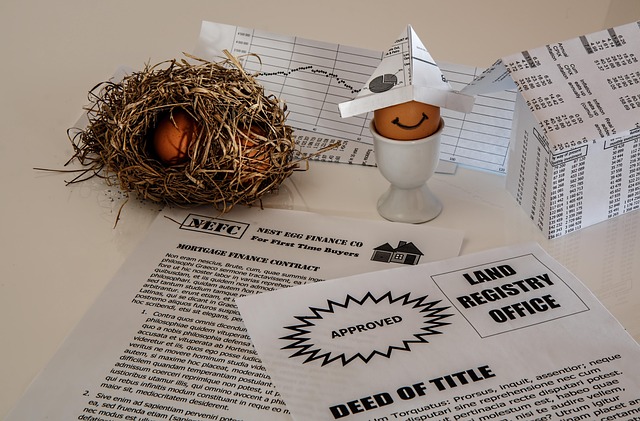

Choosing a legitimate title loan company is crucial for fair and transparent borrowing. Verify their regulatory compliance, licensing, certifications, and membership in trade associations like NADA or CFSA to protect against predatory lending. Reputable lenders offer diverse services, conduct thorough vehicle inspections, and adhere to state guidelines, ensuring borrowers receive fair treatment and protective measures when securing short-term financial assistance using their vehicle as collateral.

Identifying legitimate title loan companies is crucial to ensuring a fair and secure borrowing experience. This article guides you through the key signs that distinguish reputable lenders from fraudulent operations. By understanding regulatory compliance, transparent communication, and customer feedback, you can make an informed decision. We’ll walk you through essential steps—from verifying industry regulations and checking online reviews to comprehending loan terms—to ensure you access a genuine and trustworthy title loan company.

- Regulatory Compliance & Licensing

- – Check for industry regulations and licensing requirements

- – Verify their membership in relevant trade associations

Regulatory Compliance & Licensing

When evaluating legitimate title loan companies, one of the most critical aspects to consider is their regulatory compliance and licensing. These companies operate within a legal framework designed to protect consumers from predatory lending practices. Legitimate operators will be licensed by state authorities and adhere to strict regulations regarding interest rates, repayment terms, and collection methods. This ensures that borrowers receive fair treatment and access to financial assistance without falling into debt traps.

By maintaining proper licensing and regulatory compliance, legitimate title loan companies promote transparency in the Title Loan Process. They provide clear terms and conditions, allowing borrowers to understand their rights and obligations. This transparency also enables consumers to compare different offers, ensuring they secure the best possible deal while keeping their vehicle as collateral, which is a significant advantage for those seeking short-term financial assistance.

– Check for industry regulations and licensing requirements

When seeking out legitimate title loan companies, one of the most critical steps is to verify their industry standing and compliance with local regulations. Every state has its own set of guidelines governing these types of loans, so ensuring the company holds the necessary licenses is paramount. Reputable lenders will proudly display their certifications, allowing potential borrowers to confirm their legitimacy. This process safeguards consumers and separates trustworthy operators from unscrupulous ones.

By checking for industry regulations and licensing, you can rest assured that the title loan company adheres to standards designed to protect borrowers’ rights. It also facilitates transparency regarding interest rates, terms, and conditions, which are significant factors when considering a vehicle equity loan. Moreover, licensed lenders typically conduct thorough vehicle inspections to assess the condition of your asset, ensuring both parties are on the same page regarding its value.

– Verify their membership in relevant trade associations

One of the most reliable ways to ensure you’re dealing with a legitimate title loan company is by verifying their membership in relevant trade associations. Reputable lenders often belong to organizations that set industry standards and promote ethical practices, such as the National Automobile Dealers Association (NADA) or the Community Financial Services Association (CFSA). These associations have strict guidelines for membership, including background checks and regular reviews, which help maintain consumer protection and fair lending practices.

Additionally, legitimate title loan companies should offer a range of services beyond just providing loans. They may facilitate semi-truck loans for those in the transportation industry or debt consolidation options to simplify multiple loan payments into one manageable repayment. These flexible solutions and consideration for diverse customer needs demonstrate the company’s commitment to serving its clients effectively.

When seeking a legitimate title loan company, regulatory compliance and trade association membership are key indicators of trustworthiness. By verifying their licensing and checking for industry affiliations, borrowers can ensure they’re dealing with reputable firms. These steps offer peace of mind and protect against potential scams, ensuring a safer and more secure lending process.